About

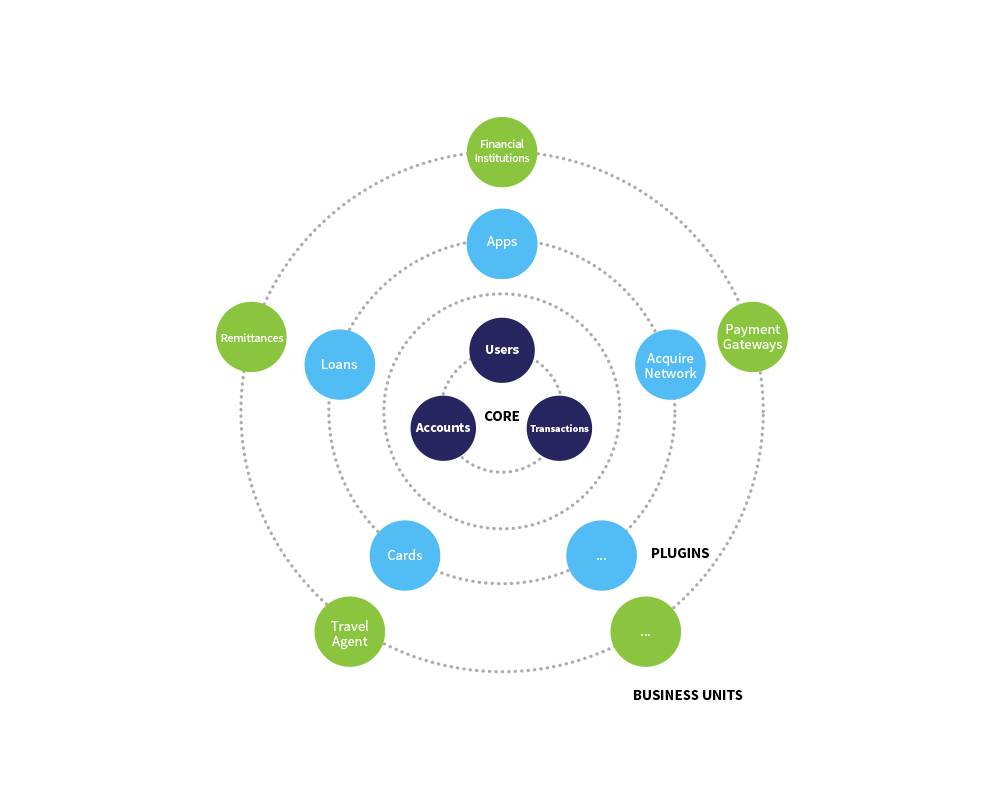

Keebank enables Codamation’s clients to launch and operate a complete suite of digital financial services, both for banked and unbanked users, without actually requiring a banking license.

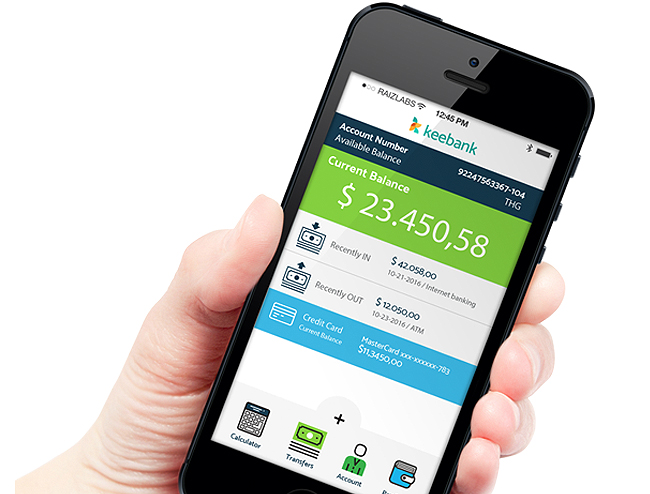

Integrates a mobile apps front-office for user interaction and a backend platform managing users, accounts and transactions, as well as generating and running transactional businesses, products, and services.

Success Story. Texto: Design, development and operation of Latin America's most widely used prepaid digital payments serviceFeatures

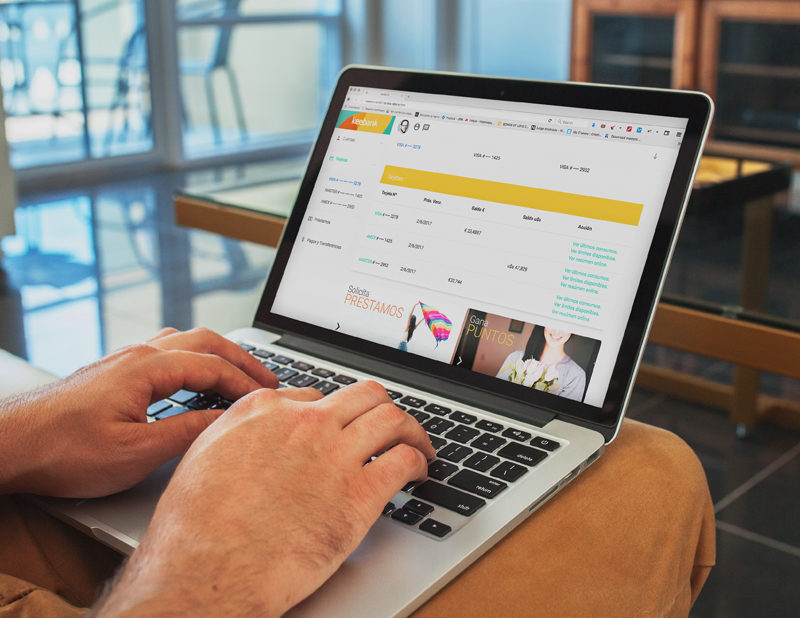

Migrate to digital banking experiences and multichannel solutions without radical redesigns and dramatic changes in legacy systems.

Use Keebank as a standalone, core banking, platform or as an agile and flexible middleware integrated to a legacy system, enabling our clients to simplify the acquisition of new types of users and the development of new businesses, products and services.

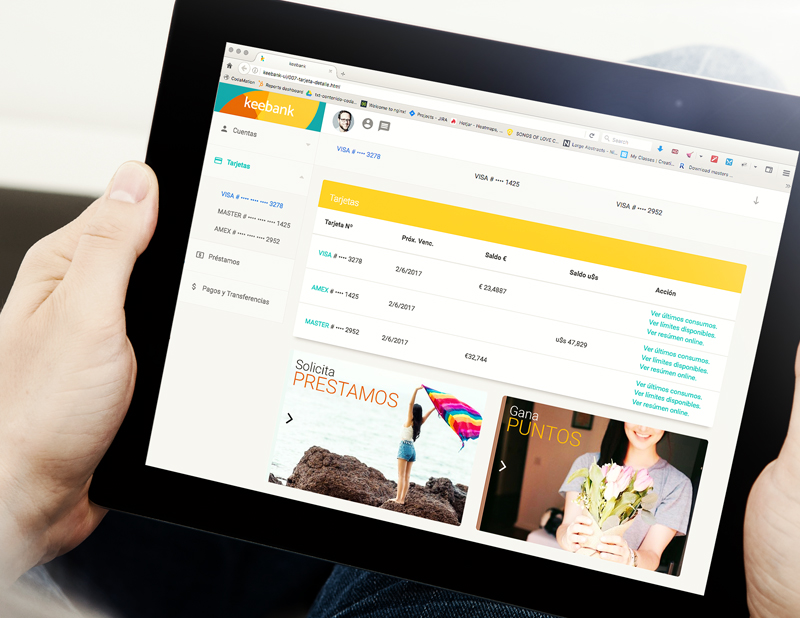

Delight your users and dramatically reduce time-to-market periods, accessing the most complete set of ready-to-use financial services

Create virtual accounts accessible via mobile apps, issue credit, debit and prepaid cards linked to them, provide cash deposits and withdrawals in non-banking correspondent networks and ATMs, offer consumer loans, enable mobile wallet or card in-store and online purchases, integrate to utility bill payment and mobile top-up gateways, and interact with third-party APIs for developing additional financial services.